Expense Payment Types

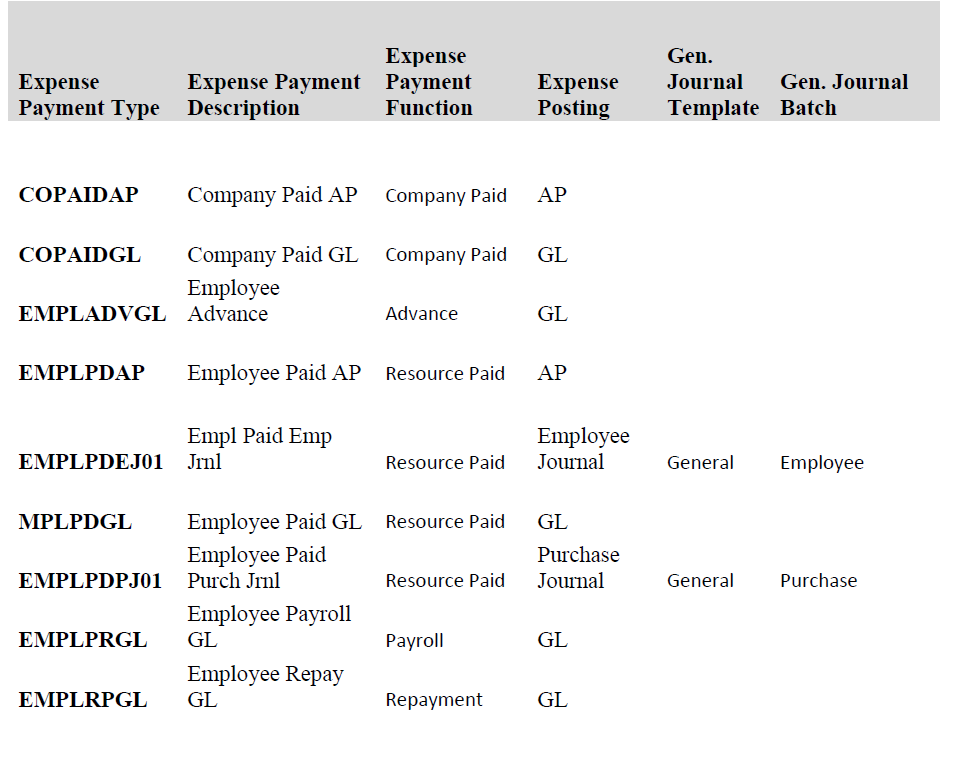

Use Expense Payments Types to establish defaults to use when expense sheets are created. Expense Types determine the journal to which the payment is posted and the expense type function For example, if it is a company paid expense, the posting is either Accounts Payable for a credit card vendor, or the General Ledger. Expense Payments Type codes are user defined. Examples of expense payment type codes:

To create a new Expense Payment Type

Navigate to the Role Center > Setup > Items and Expense Setup > Expense Payment Types.

Select New from the ribbon. Complete the following fields:

| Field Name | Description |

|---|---|

| Expense Payment Type |

Create a unique code for the new Payment Type. |

| Expense Payment Description | Specify a description for this Expense Payment Type. |

| Expense Payment Function | Select the function for this Expense Payment Type. Payment Function lists the various methods by which an expense might be paid. For example, the Payment Function can define whether the expense was paid for by Company funds, by the Resource, is a Repayment, or an Advance to the Employee. Options:

|

| Expense Posting | Select where the entries with the Expense Payment Type will post and the effect. Options:

|

| Gen. Journal Template | Select the General Journal Template to use for entries with the Expense Posting type of GL. |

| Gen. Journal Batch: | Select the name of the General Journal Batch to use for entries with the Expense Posting Type of GL. |

VAT Tax fields (Canadian localizations only)

There are a couple of places to enable VAT tax fields when using a Canadian localization.

- In the General Ledger Setup > General FastTab, locate the VAT in Use field. Enabling this field specifies if you are posting US sales tax (disabled) or CA VAT tax (enabled) and do not want to have to set up Posting Groups on G/L Accounts.

Once the VAT in Use field is enabled, in a tenant with Canadian localization, the VAT fields are viewable in the Expense Sheet Entry lines where Tax Code fields are normally found.

For example, in a tenant where the localization is a US Company and the VAT in Use is enabled, there will be no change - the tax fields in the Expense Sheet line will show as Tax Bus Posting Group, Tax Prod Posting Group. However, in a Canadian localization company, the fields will display as VAT Bus Posting Group and VAT Prod Posting Group.

Note

Regardless of whether VAT in Use is enabled or not in a company with US or Canada localization, the Tax group code Emp. Exp field name will not change.